|

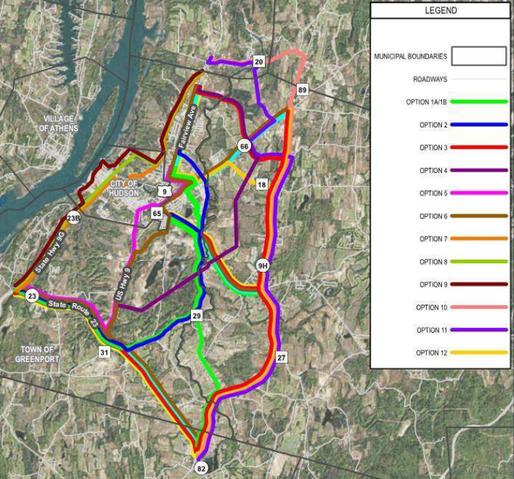

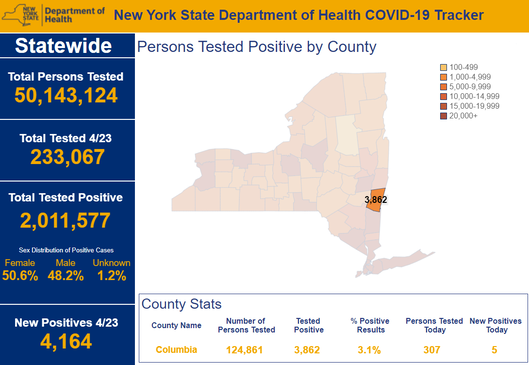

HUDSON SEEKS TO REROUTE TRUCKS New Route Would Push Trucks Out of Hudson into Neighboring Towns The City of Hudson is working to have the established truck route moved out of their city and into neighboring towns, including the Town of Claverack. This could mean significant impacts to the roadways, homes and businesses where the truck traffic would be rerouted. Among the proposals is to reroute all truck traffic up Route 9H/23 and onto Route 23B, through the hamlet of Claverack. This is unacceptable. Other possibilities in the study commissioned by the City of Hudson would move the truck route to Spook Rock Rd, a county road that is full of twists and turns. This too would be unacceptable. The City of Hudson invites community members to participate in a virtual public meeting on Tuesday, April 27, 2021 at 6:00 PM via Zoom. Registration is required for the event. I will oppose any plan to move the truck route, that largely serves the greater Hudson/Greenport commercial district, out of Hudson and into Claverack. I would encourage you to speak up and do the same! COUNTY COVID CASES CONTINUE TO DECLINE Help Available to Seniors and Homebound Residents The COVID-19 infection rate continues to be low in Columbia County with just 40 active cases reported countywide as of Friday, April 23rd. That's the lowest numbers we've seen since October 2020. That's very good news! This is do, in part, to residents being vaccinated. Over 45% of Columbia County residents have now received at least one shot of the vaccine. New York State is providing vaccine for CCDOH vaccination clinics for anyone who works or resides in Columbia County and is 16+ years old (Pfizer vaccine). Please check the CCDOH website for posted registration links. Columbia County seniors and/or homebound residents in need of assistance getting themselves registered for the COVID-19 vaccine are encouraged to contact the county call center Monday through Friday from 9 a.m. to 4 p.m. The telephone number is 518-697-5560. NOTICE FROM TOWN ASSESSOR CHARLES BREWER Pursuant to Sections 506 and 526 of the Real Property Tax Law:

Notice is hereby given that the Tentative Assessment Roll for the Town of Claverack is completed, and a copy thereof may be seen at the Town of Claverack Office Building, 91 Church St., Mellenville, NY until May 15th, 2021. Notice is hereby given that an Assessor will be in attendance with the Tentative Assessment Roll for the Town of Claverack at the Town Office Building during the hours of 10 AM to 2 PM May 6th and May 11th, on the following two days May 13th, 6-8 PM and May 15th 10 AM to 2 PM. Notice is hereby given that the Board of Assessment Review for the Town of Claverack will meet to hear and examine all properly filed complaints in relation to assessments of Real Property at the Town Office Bldg., 91 Church St., Mellenville, NY during the hours 4 PM to 8 PM on May 25th, 2021. A publication containing procedures for contesting an assessment is available at the Assessor’s Office or the Columbia County Real Property Tax Office as well as online here. Charles W. Brewer

0 Comments

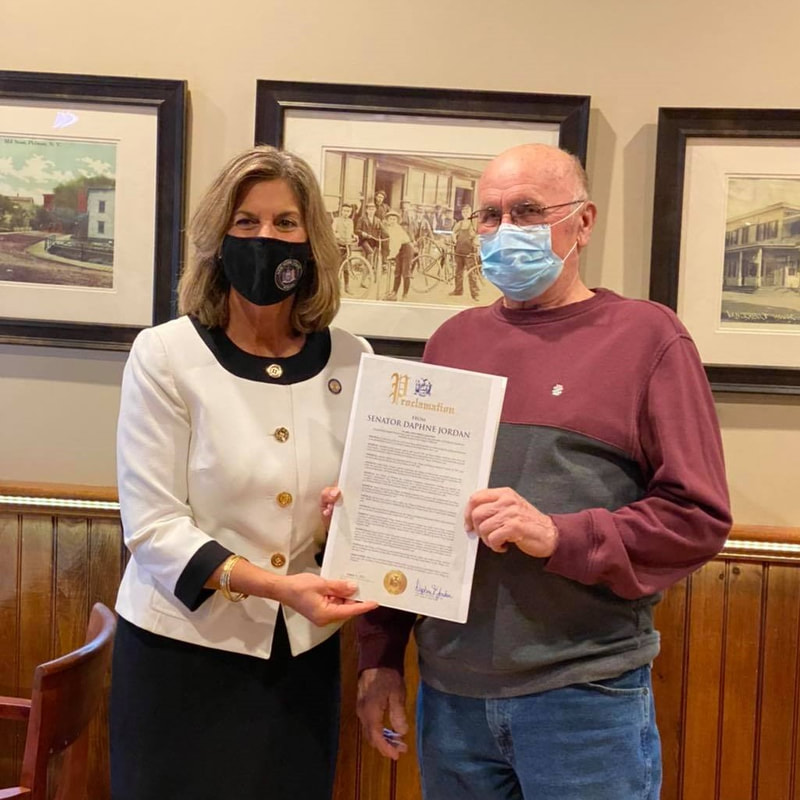

FOUR FAMILIES HOMELESS AFTER PHILMONT BLAZE Donations being accepted. Four families are homeless after a huge fire ripped through an apartment building and a second home in the Village of Philmont. The fire was reported to Columbia County 911 Tuesday morning, shortly after 10 AM. The fire started at a row house on Block Street before spreading to a nearby home on Main Street. The Philmont Fire Company was aided by several surrounding fire departments, with others providing standby coverage. All told, over 20 fire departments were involved with additional public safety agencies providing support at the scene. The blaze left 14 people homeless. Various efforts have been organized to collect donations for those affected. More information on that below. On behalf of the entire Town Board, I'd like to thank the Philmont Fire Company, the Mellenville Fire Company, A.B. Shaw, Churchtown and the many other mutual aid fire companies who responded to this terrible fire. We also thank the local businesses - like Mcnan's Variety Foods, High Falls Pizzeria, Cumberland Farms and others - who came together, as they so often do, to support the firefighters as they worked to extinguish the fire. To help the families, consider donating in any of the following ways: Philmont Clerk/Treasurer Our Community Cares GoFundMe for the Wallace Family GoFundMe for the Khan Family GoFundMe for the Palumbo Family SKIP SPEED HONORED FOR YEARS OF SERVICE I was happy to join New York State Senator Daphne Jordan, incumbent Philmont Mayor Brian Johnson, Deputy Mayor Doug Cropper, past and present village officials and employees, and a host of friends and family to acknowledge and thank Philmont Mayor Skip Speed for his many years of service to the Village of Philmont at the Village's annual Organizational Meeting on Monday, April 5th. Senator Jordan presented Skip with a New York State legislative proclamation, and I was honored to present him with a proclamation from the Columbia County Board of Supervisors. Deputy Mayor Doug Cropper also honored Skip, on behalf of the Village Board, by handing over the blue sign that proclaimed his service as Mayor for years as you entered the village on Route 217. We thank you Skip for your years of service, and look forward to working with the new Mayor and Village Board on joint projects of mutual benefit moving forward. HOOKIE'S COOK'IN CHICKEN Advance sale only -- get your tickets by April 17th.  Tickets are on sale now for the Claverack Republican Team Chicken Barbecue slated for April 29th at the Claverack Firehouse on Route 23. This will be an advance sale only (no tickets at the door) / take-out only event. Deputy Town Supervisor Steve Hook will be serving up his famous secret recipe barbecue chicken, complete with potato salad, coleslaw, dinner roll and drink. Pick up will be 4:00 pm to 6:30 pm on the 29th. This event will sell out! Order your tickets by April 17th online here, or by calling 518-813-2516 or 518-851-7570. TOWN ASSESSOR COMPLETES TOWN-WIDE REVALUATION What do updated assessments mean for you? Recently, Claverack property owners received a notice from Town of Claverack Assessor Charles Brewer regarding their new preliminary assessments. These assessments were the result of a town wide revaluation to bring all assessments up to current full-market value. It’s important that we understand what a revaluation does, and doesn’t do. I’ll try to explain. Read the full story here!

What do updated assessments mean for you? Recently, Claverack property owners received a notice from Town of Claverack Assessor Charles Brewer regarding their new preliminary assessments. These assessments were the result of a town wide revaluation to bring all assessments up to current full-market value. It’s important that we understand what a revaluation does, and doesn’t do. I’ll try to explain that a bit below for you. BACKGROUND -- It’s been ten years (2011) since the Town of Claverack completed a revaluation; a process that does not necessarily increase taxes, but rather revaluates everyone’s property to ensure no one is paying more than their fair share of the tax levy. All municipalities conduct revaluations to ensure compliance with State standards requiring that assessments be at a uniform percentage of market value. In other words, we need to make sure that property owner "John Jones" is paying the same percentage of value as property owner "Sally Smith." It’s simply about fairness and equity. THE PROCESS -- The town wide reassessment project was a collaborative effort of the Town Assessor's office and the Columbia County Real Property Tax Service Agency. Columbia County assisted the Assessor with data verification, valuation support and guidance throughout the project. In January 2020, data collectors began data verification and took photos for the Assessor of all parcels in the Town. In September 2020, a letter was sent to residential property owners which showed the inventory for their property; such as land size, square footage, number of bedrooms and bathrooms, pools, garages, sheds, etc. Property owners at that time were asked to review the data and return any corrections to the Assessor. The Assessor then reviewed the corrections and updated his file accordingly. The final stage of the project was to value the properties based on the updated inventory. Once valuation was completed, notices of preliminary assessments/market value were mailed to all property owners in March 2021. WHAT DOES A HIGHER ASSESSED VALUE MEAN FOR YOU -- First and foremost, it is expected that your assessment will rise over the course of ten years. This is perfectly normal. A higher assessment does not necessarily mean that your property taxes will go up. In fact, most property owner’s town taxes will stay the same or even go down – even though their assessments went up. Weird, right? Not really, if you understand the process. Let me try to explain. Think of the total amount of taxes collected as a pie. A revaluation does not increase the size of the pie. The pie (tax levy) stays exactly the same. The revaluation simply ensures that the pie is cut up fairly; that taxes are fairly distributed based on current market values. That said, you may feel that the Assessor is valuing your property for more than it’s worth, resulting in you paying more than your fair share of the tax burden. If that’s the case, keep reading for information on how to protest your assessment. DISPUTING YOUR ASSESSMENT -- Let’s face it, you may not agree with the Assessor on the valuation of your property. In the 2021 Assessment Notification that was mailed to all property owners on March 18th and 19th, property owners who disagree with their preliminary assessment were advised to schedule an appointment to speak with a representative of the Assessor's office. All information/documentation from those meetings are forwarded to the Assessor and a final review of those assessments will be completed by the Assessor. Property owners that scheduled an appointment will receive the Assessor's decision in early May. The tentative assessment roll will be filed on or about May 1, 2021 and will be published online. If any property owner at that time does not agree with their tentative assessment they can complete a grievance application (RP-524) and submit it to the Town Board of Assessment Review on or before Grievance Day, May 25, 2021. IN CLOSINGI hope I’ve been able to help you better understand the revaluation process and what the end result may mean for you.

I’m including here a brochure from the New York State Office of Real Property Tax Services, that addresses some of the frequently asked questions about the reassessment process. I would encourage anyone with questions to contact the County Real Property Tax Service Agency, the Town Assessors office or a member of the Town Board. We've worked hard to keep town taxes low, even cutting taxes the past several years. This revaluation project is not an attempt to raise taxes, I give you my word on that. It's simply about making sure that the existing tax burden is distributed fairly and equitably. Again, if you have questions, please call the County Real Property Tax Service Agency and they'll help you understand the process. If you think the Assessor has your property valued too high, dispute your assessment following the steps outlined above. -Kippy The Town Board is seeking interested individuals to serve on the Claverack Planning Board, the Claverack Zoning Board of Appeals, and the Claverack Board of Assessment Review. Interested parties should submit a letter of interest to Claverack Town Clerk Mary Jeanne Hoose - PO Box V, Mellenville, NY 12544.

|

Archives

April 2022

Categories

All

|

RSS Feed

RSS Feed